My algo-trading journey thus far.

My algorithmic trading journey wouldn’t be complete without discussing my prior experience in the financial markets. I started in 2015 while completing my undergraduate degree in Engineering.

2015 - I started trading stocks following IBD recommendations.

I listened to “How to make money in Stocks” by William O'Neil on a road trip and got inspired. The trading method was very systematic and based on a company rating system developed by O’Neil. IBD, the company started by O’Neil, offers access to their rating system for a monthly subscription. After the road trip, I subscribed to IBD and started making trades based on their IBD 50 list.

My first position was CALM, I purchased them ahead of a big announcement that McDonald’s would be using their eggs for 24 hour breakfast. My next position was NTES, a Chinese gaming company. Both IBD recommendations.

Their recommendations were profitable and would take 1 to 3 months to see a return. Meanwhile I would pay 3 months of fees for one or two recommendations. So I decided to replicate their systems and code my own scanner. This worked remotely well.

2016 - I was introduced Options and the Forex Market

I joined a Meetup Group for traders in college. I told them that I would trade stocks using a scanner based on IBD metrics. They informed me that I was doing wrong, and I should be instead trading options. They went on about delta, gammas, and so forth, and my eyes glazed over. I had enough calculus in my everyday life.

Later that year, I made friends with a guy in a local coffee shop. As life would have it, he was an options trader. Everyday he would go to the coffee shop, read the options chain, and supposedly make money. He explained to me how he trades options, and I figure every thing he was doing sounded too complicated. But he retired his parents and quit his job using options.

While researching options I stumbled upon Binary Options, a risky binary bet on whether a security price will be higher or lower than your bet price by a certain time. I thought this was much simpler than the options my coffee shop friend was doing, so I decided to focus on these type of options.

Binary options mostly focused on Forex prices, and by proxy I was learning about the Forex market while trying to find an edge in Binary Options. I started making indicators to alert me for good Binary Options trading opportunity and this was my introduction to the Forex Market.

2017 - Discovering a need for algorithms

At the time Nadex, the only regulated Binary Options broker in the US, didn’t allow algorithmic trading for binary options, so I manually traded based on my indicator signals.

Around this time my job was getting more busy, so I needed a way to trade without being involved. I started to put money from Binary Options profits into a traditional Forex account to build algorithms around. At this time I was studying systems that were on the market, and backtesting a lot. No algorithms were live in the market.

2018 - Going Live

In 2018, I got serious with the idea of algorithmic trading.

A snapshot of my Trading Journal in 2018 with one goal.

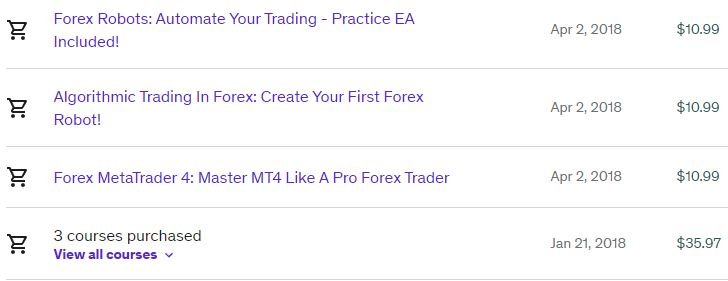

I purchased 6 courses on algorithmic trading in Forex to learn the basics.

A snapshot of my Udemy purchase history in 2018.

I studied every course that I took, did the quizzes, assignments and built the codes from each instructor. Some instructors provided sample codes with their courses, these helped with my understanding of code structure and complete algorithm development.

After the courses I started developing indicators and trading robots for the Forex market in Metatrader 4, searching for an edge I could exploit consistently.

The first trading algorithm I made was based on trend following according to Bill Williams, in Trading Chaos. I put some money into a trading account and allowed the algorithm to trade it. I would come home each day and review what it did. This was a period of trial and error with real money.

Over the year, I modified the algorithm to include more filters, take less trades and increase my profit expectancy. After mastering this algorithm I went on to building others.

2019 - Finding an Edge

My goal for this year was to keep my first algorithm in the market until I could build an algorithm, or portfolio that could beat it.

I discovered trading podcasts and became a student. Most notable podcasts were Chat with Traders podcast, Better Systems Trader, and Top Traders Unplugged.

I read most of the top books around algorithmic trading to get a better understanding of what edges other people were exploiting.

I took more courses on Udemy and Coursera to sharpen my skills on specific algorithmic trading principles, Forex, statistics, data analysis for the financial markets, and Machine Learning.

A bit of luck?

While I was studying the Forex market, one of my indicators had a buy signal on Bitcoin. I bought the Bitcoin using my Robinhood account (see below). This was before I understood that you should purchase Bitcoins in a place where you can control your keys.

A Snapshot of my Bitcoin purchases on Robinhood.

Regardless, later that year I left my job.

I used my extra time to dive deeper into trading books, courses, and developing an algorithmic portfolio.

I subscribed to Stocks & Commodities Magazine, because Perry Kaufman, a frequent guest on these podcasts, would post in Stocks & Commodities Magazine.

By the end of the year I had a portfolio of algorithms that I built, tested and have deployed in the markets.

2020 - Refining the portfolio

At this point I had accounts at different brokers including, FXChoice, Forex.com, and Tradersways. My laptop was doing a lot of heavy lifting, overheating frequently.

My 2020 setup, a 5 year old laptop that would overheat from running algorithms 24/6.

As my total account value grew, I wanted to consolidate my accounts at a broker that is “trusted” (Forex.com). The downside of this is I had less leverage to work with.

With less leverage, I needed to trade less algorithms. This lead me to refining my portfolio from 8 algorithms, to 3 uncorrelated profitable algorithms.

Today I still only use these 3 algorithms.

I learned about prop firms and decided to try my algorithms on their accounts. Prop firm accounts would provide me with additional capital, and higher leverage than I could get from US brokers. So this seemed like a win-win scenario.

I started posting on reddit discussing algorithms performance after making ~2% in a month.

My algorithms ended the year up ~20% and had 2 prop firm accounts at FTMO.

2021 - Scaling & Executing

A year after my first reddit post, I posted again to discuss how I made 74% return that year.

My 2021 performance posted on reddit.

My goal for this year was to get more prop firm accounts and replace my fledging laptop lol.

First, I built a better computer. I took some trading profits and built a computer to handle my algorithms. It was the first computer I built and the process was fun.

Then I offloaded some prop firm accounts to a cloud server, which freed up my computer from executing trades.

With my new computer I spent most of the time building and backtesting new algorithms. The goal, as always, was to build algorithms better than the ones I had in my portfolio.

I refined my development process more to be the process shown below.

My next goal was to maximize the impact of my algorithms and start a hedge fund.

I decided to start the Billion Dollar Algorithms Podcast to document my process of starting this hedge fund and see how far I can take it.

And now you’re watching this process in real-time.

2022 and Beyond…

The 2022 chapter is still being written. I will update this at the end of the year with the developments I am working on. Until then, you can follow along by subscribing to the Podcast here.